kick the markets @$$

Maximize the performance of your portfolio with AI hedge fund strategies

2x Your Portfolio Performance

Get Hedge Fund-level strategies to enhance the performance of your portfolio. Easy to setup and fully customizable to your investing style.

There’s a ton of content out there about picking the right stocks. But once you’ve picked them, how do you get the most out of them?

Hedge Funds and sophisticated investors rarely buy and hope (hold). They manage their positions to maximize their chances of profit.

Munny Tree gives you the ability to do the same with just a few clicks.

200%+

more gains

Billions

data points analyzed

Custom

AI models

The fastest and easiest way to optimize your portfolio performance

Goals

Get strategies based on your personal goals for your portfolio

Market Sentiment

Tell us your how you feel about the market and we will provide strategies designed to optimize your portfolio performance within that market environment

Insights

See details about each suggested strategy. Profit potential, probabilities, and other metrics to help you make the best decision

Personalized

No one-size-fits-all here. Get strategies specific to your portfolio and needs

Portfolio Tracker

We help you keep track of the performance of your portfolio and get insights into how your portfolio is doing against benchmarks, explanations for large market moves, and things to look out for customized based on the equities you own.

Performance Strategies

Our bread and butter! Personalized strategies to help you maximize the performance of your portfolio.

Our strategist enhance your portfolio, on average, by up to 1% per month.

Learn & Adapt

Our investment models learn from you. We keep track of which strategies you like, implement, and how they perform to provide you with the best strategies.

You also benefit from all of our other users helping inform our models.

Alerts

Get notified when great strategies and opportunities become viable or if we see speed bumps around the corner and how to counteract them.

We keep an eye on the market and your portfolio so you don’t have to.

You’ll wonder why Finance Bro’s make this sound so complicated

Here’s How it Works

(In just a few minutes you’ll be off and running)

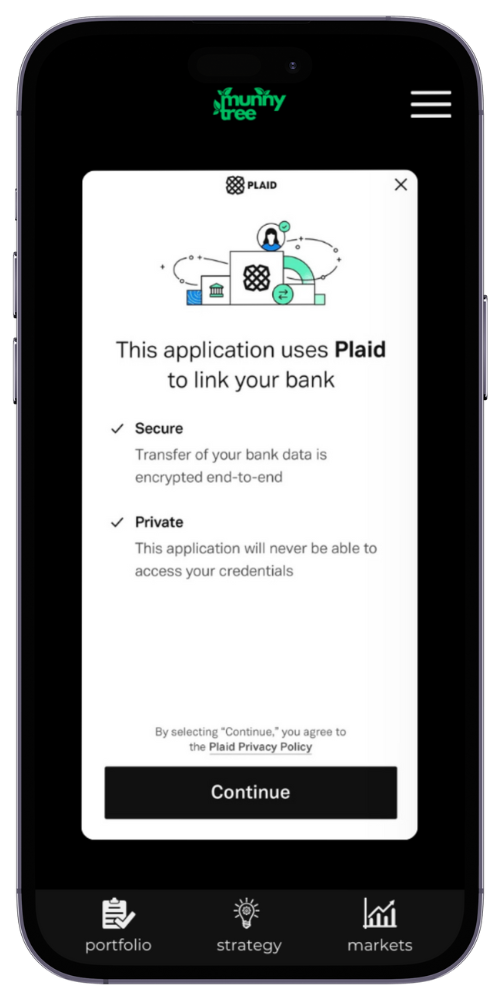

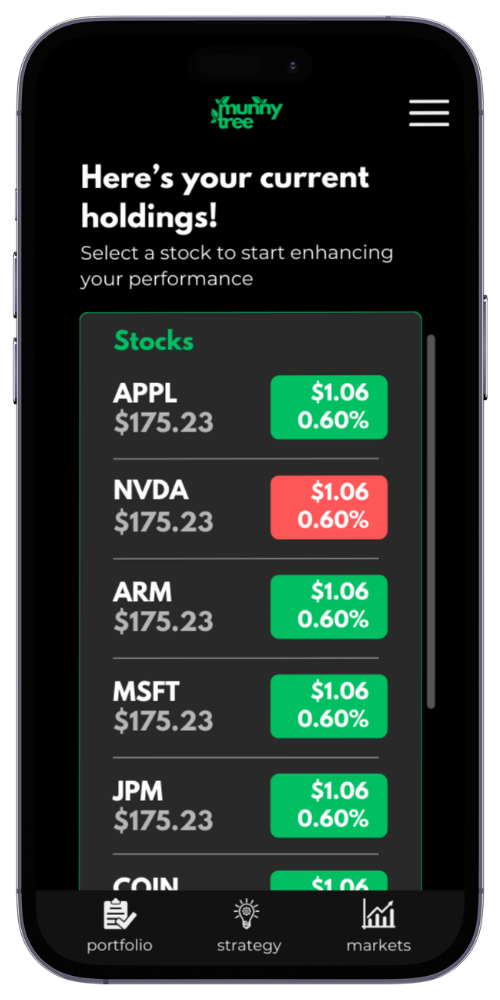

Step 1: Connect your portfolio to Munny Tree

We use Plaid to make it easy for you to connect your portfolio to our platform. We use a “read only” connection so that we can only see your stock holdings.

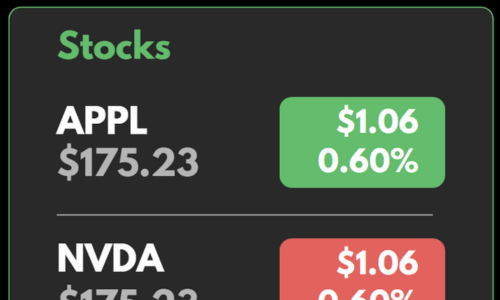

Step 2: Select stock(s) to optimize

Once connected, we will show you your portfolio and allow you to select each position to get the gears of our platform moving. We will use our proprietary models to take your portfolio status and personal goals into account and present strategies that best match your performance goals.

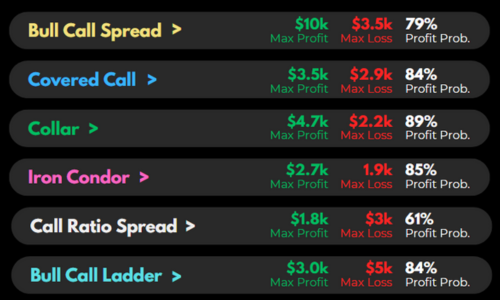

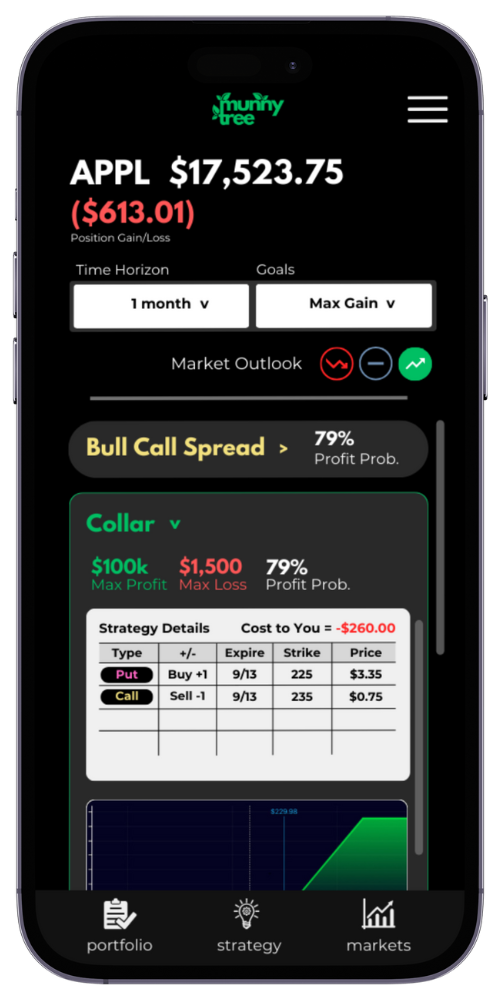

Step 3: Evaluate suggested strategies

You can easily see which strategies we suggest and evaluate which one might be the best choice for you. We predict the strategies probability of profit, max gains, and max loss in order to provide you with all the info you need to make a great investment decision.

Step 4: Trade with your Broker

Use your broker to place the trades that you’ve selected. We provide all the “how to” in order to understand what to buy/sell and when. All you have to do is follow the steps.

Pricing

$20/month

Billed Annually ($240 per year)

7 day free trial

We are currently in Private Beta. We plan to open up a free, invite-only Public Beta soon. Click Sign Up Below to get early access to our platform for $0.

Unlimited Personalized Strategies

Fund Portfolio Builder (coming soon)

Portfolio Tracking

Alerts to keep you informed

Performance Insights & Probabilities

Answers to your investment questions

What. The. FAQ.

How do I get started?

In order to get started you just need to own stocks/ETF’s in a broker. Once you sign up with us we will connect to your broker to analyze your portfolio and provide strategic guidance based on just a few inputs from you; such as your market outlook and time horizon you are working with. From that we can start providing strategies to boost the performance of your portfolio. It’s that easy!

Are you executing trades for me?

No. We are not a broker. Nor do we send alerts or signals to your broker for trades. Our connection to your broker is purely “read only” for the purposes of analyzing your portfolio and providing trading strategies.

To place the trades you will use your brokers website. We will provide all the “how to” on what to buy, at what price, dates, and other details. You just have to follow the instructions.

How does the platform tailor strategies to my goals?

Our platform allows you to tell us your goals and ideal time horizon for each stock that you own. Based on that, the details about your holdings, and our learned AI model we can ensure the strategies we suggest match your preferred outcomes.

What kinds of strategies does the platform provide?

Our platform uses a variety of strategies, including stock options, protective puts, covered calls, and more. Each strategy is chosen based on your portfolio, goals, and risk tolerance.

Most of our strategies will be options based. Options are a powerful tool in the investment toolbox to meet your goals.

Can the platform help me if I have little experience with options?

Yes! Our platform simplifies options strategies and provides clear guidance on how to implement them, even if you’re new to options trading or advanced portfolio management.

Options are just another type of equity asset you can buy/sell. When paired with stocks they can be work wonders. They are not without their risks, like stocks or any other investment, but we ensure you have all the information on what is best and why.

Is my data secure on the platform?

We take data privacy and security very seriously. Your personal and financial information is encrypted and stored securely following industry standards.

What types of investors is this platform best suited for?

Our platform can be used by all investors. Ideally you would come with some basic understanding of investing, your goals, and a curiosity to learn new strategies to help you build your portfolio and wealth.