Investing is like baking a cake. You start with solid ingredients—stocks, bonds, maybe a sprinkle of real estate. But what if you could make that cake even better with just a little extra effort? That’s where options come in—a layer of icing that can turn your plain vanilla portfolio into something truly mouthwatering, whether you’re aiming to maximize your gains in a bull market or preserve your capital in a bear market. Let’s dive into why adding an options strategy to your portfolio can be as sweet as it sounds.

Sign Up to get Actionable Tactics to implement strategies just like these

Don’t Let Options Intimidate You—They’re Just Another Tool in Your Kit

We get it—options can seem a little intimidating at first. They’ve got their own lingo, and the idea of adding them to your portfolio might feel like taking on a new hobby that’s slightly out of your comfort zone. But here’s the truth: options are just another asset, like stocks or bonds, that you can include in your portfolio. When paired with an underlying stock, they can actually be a very safe way to accelerate your gains or hedge against losses. Think of them as the Swiss Army knife of investing—they might seem complex, but with a little practice, they can become one of the most versatile and useful tools you have.

Making the Most of a Bull Market: Boosting Gains with Options

When the market is soaring, and stocks are climbing like they’re on a never-ending rollercoaster, you want to maximize your returns. Here are a couple of examples of how options can help you do just that (These are some examples based on broad conditions. There are many other strategies that might be right for your portfolio. This is just a jumping off point):

Covered Call

Cash In on Those Gains Without Letting Go

How It Works

You own shares of a stock that you believe will keep climbing, but you’re okay if they don’t shoot to the moon. You sell a call option on that stock, collecting a premium while agreeing to sell your shares if the stock price hits a certain level.

Why It’s Useful

It’s like renting out a spare room in your house—extra income without losing the house. If the stock doesn’t hit the strike price, you keep your shares and the premium. If it does, you still make a profit from the stock’s rise.

Tactics

In a bull market you will get higher premiums which will maximize your gains. Be sure to select strike price at levels you are comfortable selling if the stock exceeds it or select a price that you are fairly certain it won’t hit so you can keep your stock and premiums

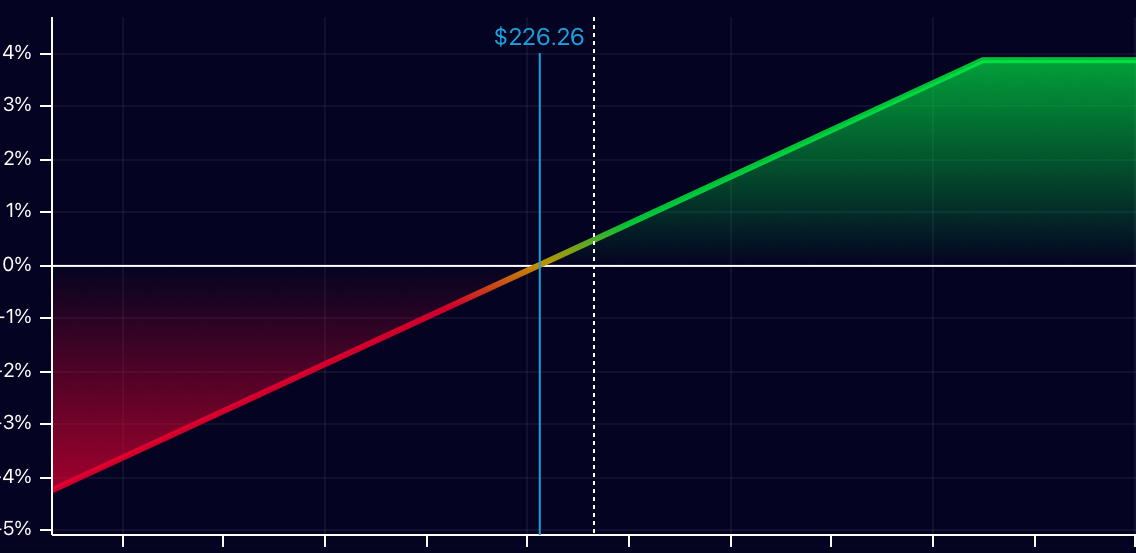

Expected Gains

4-5%+ Additional Gains can be expected on top of your portfolio performance when using Covered Calls effectively. In the above example (Apple), if the stock goes up 5%, with a Covered Call strategy you would be up 6%. A small boost for a very safe strategy!

Potential Downside

If the stock skyrockets, you might kick yourself for selling it at a lower price. It’s like selling concert tickets at face value only to find out they’re now worth double. You miss out on those potential gains.

Bull Call Spread

A Risk-Managed Bet on Market Upside

How It Works

You buy a call option at one strike price and sell another call at a higher strike price. This limits both your potential gains and losses.

Why It’s Useful

It’s like buying insurance on a new gadget—if it breaks, you’re covered without shelling out a fortune. You get to participate in the upside but with a cap, making it a safer bet if you think the market will rise but not too much.

Tactics

If you don’t want to worry about having to sell your stock and want to accelerate your gains as the stock goes up, this is the strategy for you. Your gains get a bonus but your losses are worsened as well. This should be used in market conditions where you are highly certain of future stock gains

Expected Gains

5-15%+ Additional Gains can be expected on top of your portfolio performance when using Bull Call Spreads effectively. In the example above (Apple) if the stock goes up 5%, with this strategy you would be up 8.2%. A nice boost on your gains!

Potential Downside

Your gains are limited. If the stock blows past your higher strike price, you don’t get to enjoy the full ride.

Playing Defense in a Bear Market: Options for Capital Preservation

When the market feels like it’s taken a wrong turn down a dark alley, and stocks are heading south, your priority shifts to protecting what you’ve got. Options can help you weather the storm. Here are a couple of examples of how options can help you protect what you have (These are some examples based on broad conditions. There are many other strategies that might be right for your portfolio. This is just a jumping off point):

Protective Put

The Security Blanket for Your Portfolio

How It Works

You own a stock but worry that it might drop. You buy a put option, which gives you the right to sell your stock at a set price, no matter how low it goes.

Why It’s Useful

Think of it as a safety net. If your stock plummets, the put option acts as a parachute, limiting your losses. It’s peace of mind wrapped up in a little contract.

Tactics

Protective puts are your best friend in a bearish or highly volatile market. They’re perfect when you’re unsure of the market’s direction and want to hedge against potential downturns.

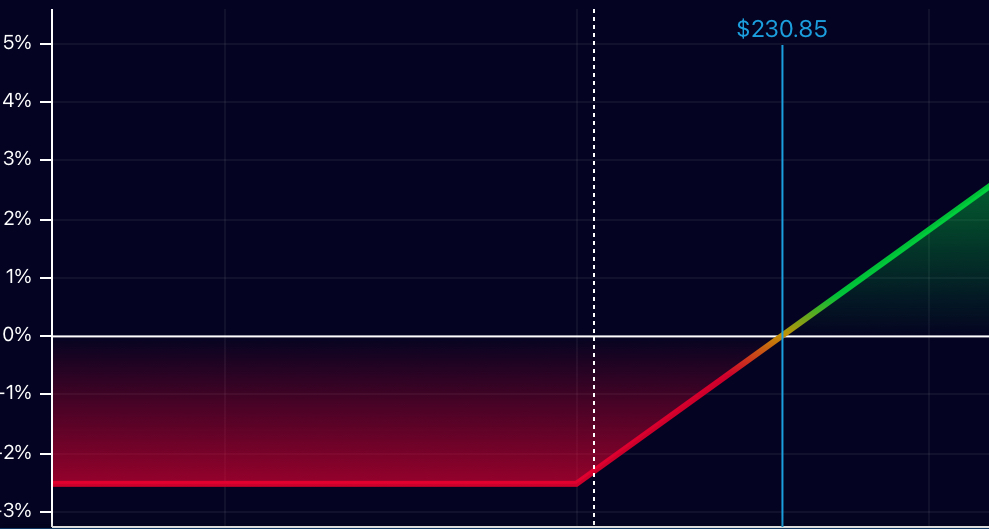

Expected Gains

Protective puts are more about loss prevention than gains, they can save you 10-15% in losses during severe market downturns, effectively cushioning your portfolio. In the above example (Apple), if the stock falls the most you can lose is 2.6%. Even if the stock falls 10%, 20%, or more, you only can lose 2.6%. It gives you peace of mind in a bear market.

Potential Downside

Like any good insurance policy, you pay for it—buying puts can get expensive, especially in a volatile market. If the stock doesn’t drop, that premium is gone, and your returns are reduced.

Collar

Conservative Play for Uncertain Times

How It Works

You own a stock, sell a call option, and use the premium from that call to buy a put option. This creates a “collar” around your stock price, limiting both your potential gains and losses.

Why It’s Useful

It’s like putting on a seatbelt—it keeps you safe while you navigate those market twists and turns. You get protection from a big drop without spending much out-of-pocket, as the call premium offsets the put cost.

Tactics

Collars are a solid strategy in a neutral or slightly bearish market. They’re useful when you expect some volatility but don’t want to risk your entire position.

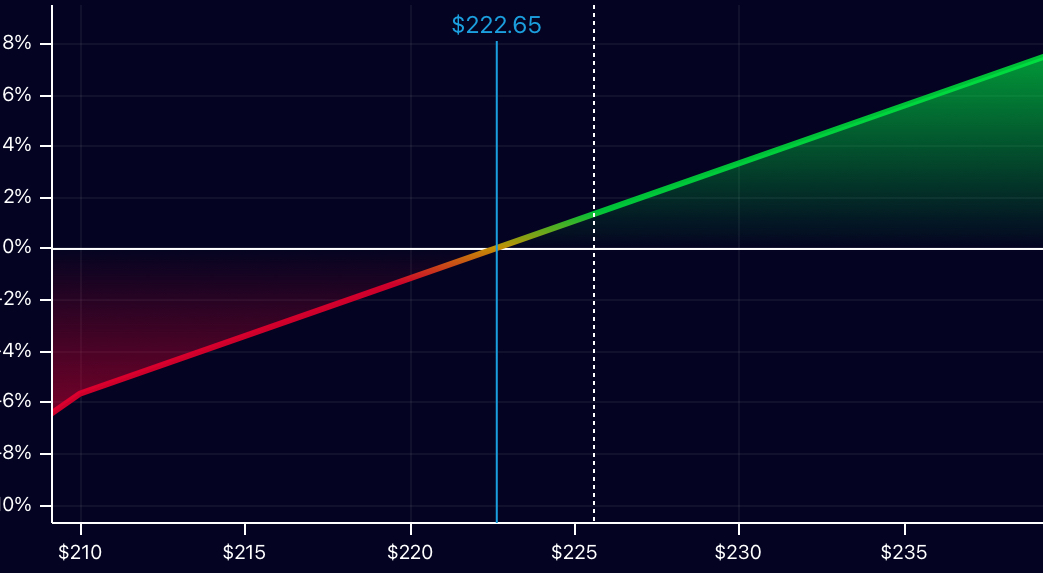

Expected Gains

A collar strategy give you protection + potential upside. They are especially useful in a position that is already profitable and you expect short-term volatility. In this situation a collar strategy might reduce losses by 5-10% in choppy markets while still allowing for modest gains if the stock price remains stable. In the above example (Apple), this strategy caps your losses at only 3.6% in a bear market but also caps your gains at 7.2% in a bull market.

Potential Downside

Your upside is capped, so if the market rebounds quickly, you’re stuck in first gear while others zoom past.

When You’re Feeling Adventurous: Strategies for a Mixed Market

Sometimes the market is just…weird. Not quite bullish, not quite bearish, just a little all over the place. Here’s how to handle that. Here are a couple of examples of how options can help you protect what you have (These are some examples based on broad conditions. There are many other strategies that might be right for your portfolio. This is just a jumping off point):

Call Ratio Spread

A Balanced Bet on a Mild Bullish Move

How It Works

You buy a call option and sell two call options at a higher strike price. This works best if you expect a mild rise in the stock price.

Why It’s Useful

It’s like bringing an umbrella on a day with a slight chance of rain—you’re prepared, but not overcommitted. You benefit if the stock rises moderately, and the extra sold call options can help cover the cost of the purchased one.

Tactics

Call ratio spreads shine in markets where you anticipate a slight to moderate increase in stock price but want to profit from stable or mildly rising conditions.

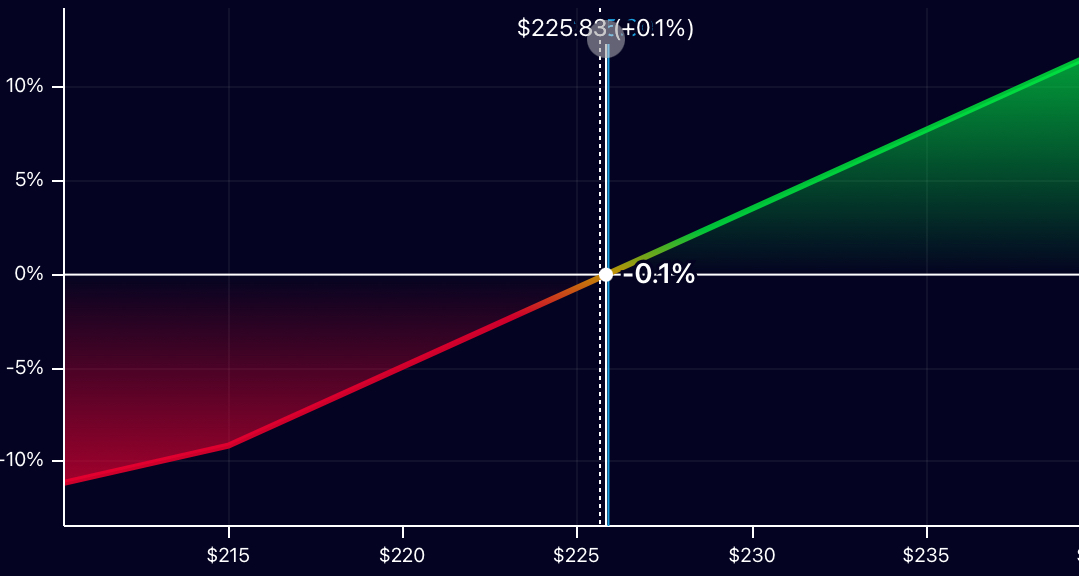

Expected Gains

If executed correctly, a call ratio spread could add 4-6% to your portfolio in a stable or mildly bullish market. In the above example (Apple), you boost your gains as the market climbs but also boost your losses. This is a good short term strategy to maximize small moves in a volatile market.

Potential Downside

If the stock rises too much, your gains are capped but your losses are not. This strategy capitalizes on volatile gains so be sure to use it in markets that lean bullish.

Covered Short Strangle

Earning in a Low-Volatility Market

How It Works

You own the stock, sell a call option at one strike price, and a put option at a lower strike price. This strategy works best when you expect the stock to stay relatively flat.

Why It’s Useful

It’s like betting on a calm sea—no storms, no waves, just smooth sailing. You collect premiums from both options, maximizing your income if the stock doesn’t move much.

Tactics

Covered short strangles are ideal in low-volatility environments where you expect the stock to remain within a narrow trading range.

Expected Gains

In a stable, low-volatility market, this strategy can boost returns by 2-4% annually, depending on the premiums collected. In the above example (Apple), you lower your break-even level by 3% and accelerate your gains. This gives you breathing room in a volatile market with the opportunity to capture gains as the stock price rises.

Potential Downside

If the stock moves sharply in either direction, you’re exposed to significant risk. It’s not for the faint of heart in a volatile market.

Conclusion: Options Are Your Portfolio’s Secret Weapon

Adding an options layer to your portfolio is like upgrading your investment toolbox with a Swiss Army knife. Whether you’re riding the wave of a bull market or hunkering down in a bear market, options strategies give you the flexibility to adapt, maximize gains, or protect your capital. Just remember, each strategy comes with its own set of risks and rewards — so choose wisely and always be prepared for whatever the market throws your way.

And remember, we’re here to help you navigate it all—no suits required!

Sign Up to get a weekly newsletter to help you identify strategies just like these completely for Free

(plus free stock picks and market news)